Many investors are amazed to find out that employing retirement resources to speculate in alternative assets has become feasible since 1974. Nonetheless, most brokerage firms and financial institutions center on presenting publicly traded securities, like stocks and bonds, simply because they lack the infrastructure and expertise to handle privately held assets, for example housing or non-public equity.

Customer Assist: Hunt for a service provider that offers dedicated assist, like usage of proficient specialists who will response questions on compliance and IRS principles.

And because some SDIRAs for instance self-directed conventional IRAs are subject matter to demanded minimal distributions (RMDs), you’ll ought to approach ahead to make certain you have sufficient liquidity to meet the rules set through the IRS.

Before opening an SDIRA, it’s important to weigh the opportunity advantages and disadvantages depending on your particular monetary objectives and hazard tolerance.

Greater investment selections signifies you are able to diversify your portfolio further than stocks, bonds, and mutual cash and hedge your portfolio from marketplace fluctuations and volatility.

Put just, for those who’re seeking a tax economical way to construct a portfolio that’s a lot more customized to the interests and abilities, an SDIRA may be The solution.

SDIRAs in many cases are utilized by fingers-on buyers who are ready to tackle the risks and duties of selecting and vetting their investments. Self directed IRA accounts can even be great for traders who've specialized information in a distinct segment market place that they would want to put money into.

Incorporating hard cash straight to your account. Keep in mind that contributions are topic to annual IRA contribution restrictions established with the IRS.

Subsequently, they have a tendency not to advertise self-directed IRAs, which supply the flexibility to take a position inside of a broader array of assets.

Feel your Good friend could possibly be setting up another Fb or Uber? By having an SDIRA, you may put money into brings about that you think in; and possibly love better returns.

Sure, housing is one of our look at these guys clientele’ most popular investments, in some cases named a property IRA. Shoppers have the option to speculate in all the things from rental Homes, business real estate property, undeveloped land, house loan notes and much more.

Simplicity of use look at this now and Technological know-how: A user-welcoming System with on the net applications to trace your investments, submit documents, and manage your account is crucial.

Real estate is among the preferred selections among the SDIRA holders. That’s simply because it is possible to put money into any kind of real-estate that has a self-directed IRA.

This involves being familiar with IRS regulations, managing investments, and keeping away from prohibited transactions which could disqualify your IRA. A lack of information could result in high priced issues.

No, you cannot invest in your individual business enterprise with a self-directed IRA. The IRS prohibits any transactions between your IRA along with your individual organization as you, given that the proprietor, are considered a disqualified man or woman.

The tax positive aspects are what make SDIRAs eye-catching For most. An SDIRA could be the two standard or Roth - the account kind you end up picking will count largely on your investment and tax system. Check out using your monetary advisor or view it now tax advisor if you’re Not sure that is most effective to suit your needs.

Confined Liquidity: Many of the alternative assets that could be held within an SDIRA, such as real estate, personal fairness, or precious metals, is probably not effortlessly liquidated. This can be a problem if you'll want to obtain resources promptly.

Earning one of the most of tax-advantaged accounts allows you to maintain more of The cash you commit and make. Based on whether you decide on a traditional self-directed IRA or a self-directed Roth IRA, you may have the prospective for tax-free or tax-deferred progress, provided selected circumstances are fulfilled.

A self-directed IRA is definitely an unbelievably potent investment car or truck, but it’s not for everyone. Since the indicating goes: with fantastic electric power arrives fantastic accountability; and with the SDIRA, that couldn’t be extra correct. Continue reading to know why an SDIRA may, or might not, be for yourself.

IRAs held at banking companies and brokerage firms offer you restricted investment solutions to their customers since they would not have the knowledge or infrastructure to administer alternative assets.

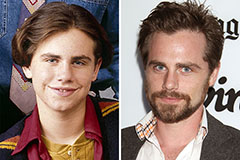

Rider Strong Then & Now!

Rider Strong Then & Now! Michael J. Fox Then & Now!

Michael J. Fox Then & Now! Andrea Barber Then & Now!

Andrea Barber Then & Now! Erika Eleniak Then & Now!

Erika Eleniak Then & Now! Naomi Grossman Then & Now!

Naomi Grossman Then & Now!